nicneo.ru

Gainers & Losers

Short Trade Stocks

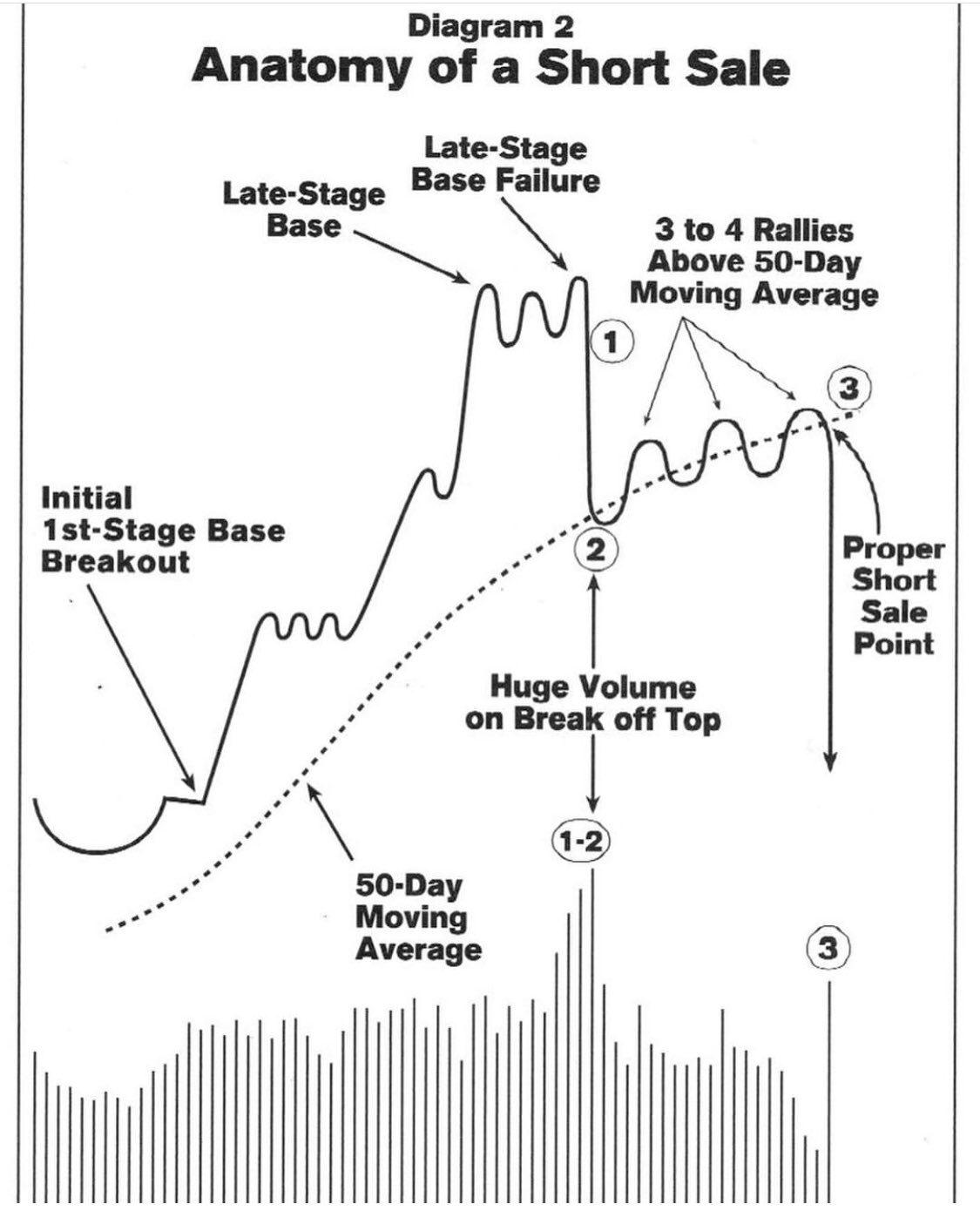

One strategy to capitalize on a downward-trending stock is selling short. This is the process of selling “borrowed” stock at the current price, then closing. Short selling is the practice of selling (borrowed) stock high with the intent to buy back at lower prices for a profit, sell high and buy back lower. Short-term strategy Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. Most Shorted Stocks ; SAVA. Cassava Sciences, Inc. , +, +% ; ABR. Arbor Realty Trust, Inc. , , %. Successful short selling involves borrowing stocks, selling the borrowed stock and buying them back at a lower price. Find out how to short stocks here. Short selling is a popular kind of trading strategy in which investors speculate on a stock price's decline. Shorting a stock, or short-selling, is a method of trading that seeks to benefit from a decline in the price of a company's shares. Short selling is a strategy that may be used to generate money off companies that have a price that is decreasing (also known as going short or shorting). In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls. One strategy to capitalize on a downward-trending stock is selling short. This is the process of selling “borrowed” stock at the current price, then closing. Short selling is the practice of selling (borrowed) stock high with the intent to buy back at lower prices for a profit, sell high and buy back lower. Short-term strategy Selling short is primarily designed for short-term opportunities in stocks or other investments that you expect to decline in price. Most Shorted Stocks ; SAVA. Cassava Sciences, Inc. , +, +% ; ABR. Arbor Realty Trust, Inc. , , %. Successful short selling involves borrowing stocks, selling the borrowed stock and buying them back at a lower price. Find out how to short stocks here. Short selling is a popular kind of trading strategy in which investors speculate on a stock price's decline. Shorting a stock, or short-selling, is a method of trading that seeks to benefit from a decline in the price of a company's shares. Short selling is a strategy that may be used to generate money off companies that have a price that is decreasing (also known as going short or shorting). In finance, being short in an asset means investing in such a way that the investor will profit if the market value of the asset falls.

Short selling aims to profit by borrowing shares from a broker, selling them, and then purchasing the shares later at a lower price (so you can give them. Meaning you can initiate the short trade anytime during the day, but you will have to buy back the shares (square off) by end of the day before the market. Find the best brokers for short selling in the U.S. Read our comprehensive guide to compare fees, features, and more. Short selling involves borrowing and selling shares with the aim to buy them back at a lower price, profiting from the difference. A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. If the price. We explain how to successfully plan and execute a short sale, why this method is so important for your returns and what to look out for. A short sale occurs when you sell stock you do not own. Investors who sell short believe the price of the stock will fall. If the price drops, you can buy. Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. Short selling is a popular kind of trading strategy in which investors speculate on a stock price's decline. Short selling is the practice of selling borrowed securities – such as stocks – hoping to be able to make a profit by buying them back at a price lower than. Short selling is the selling of a stock that the seller doesn't own. More specifically, a short sale is the sale of a security that isn't owned by the seller. Most Shorted Stocks ; MAXN · Maxeon Solar Technologies Ltd. $ ; RILY · B. Riley Financial Inc. $ ; DGLY · Digital Ally Inc. $ ; PLCE · Children's Place Inc. When you sell short you borrow shares from your broker and sell them. You have to have a certain amount of collateral (assets) in your account. A short sale occurs when you sell stock you do not own. Investors who sell short believe the price of the stock will fall. If the price drops, you can buy. By short selling, traders can profit when the value of an asset depreciates. Learn how to shorting a stock, how to buy long & sell short. How to short sell stocks Short selling is used to take advantage of share prices that are expected to decline. There are a range of ways to short a stock, so. Short selling is an investment strategy when an investor expects that value on a stock to go down. Its extremely high-risk since investors are borrowing stocks. Short trading is a popular strategy among many investors, as it enables them to benefit from falling prices - and markets fall quite often indeed. Short selling refers to borrowing stocks (usually from your broker) so as to sell them at the prevailing market prices, with the hope of buying them at a. Short selling is an investment strategy when an investor expects that value on a stock to go down. Its extremely high-risk since investors are borrowing stocks.

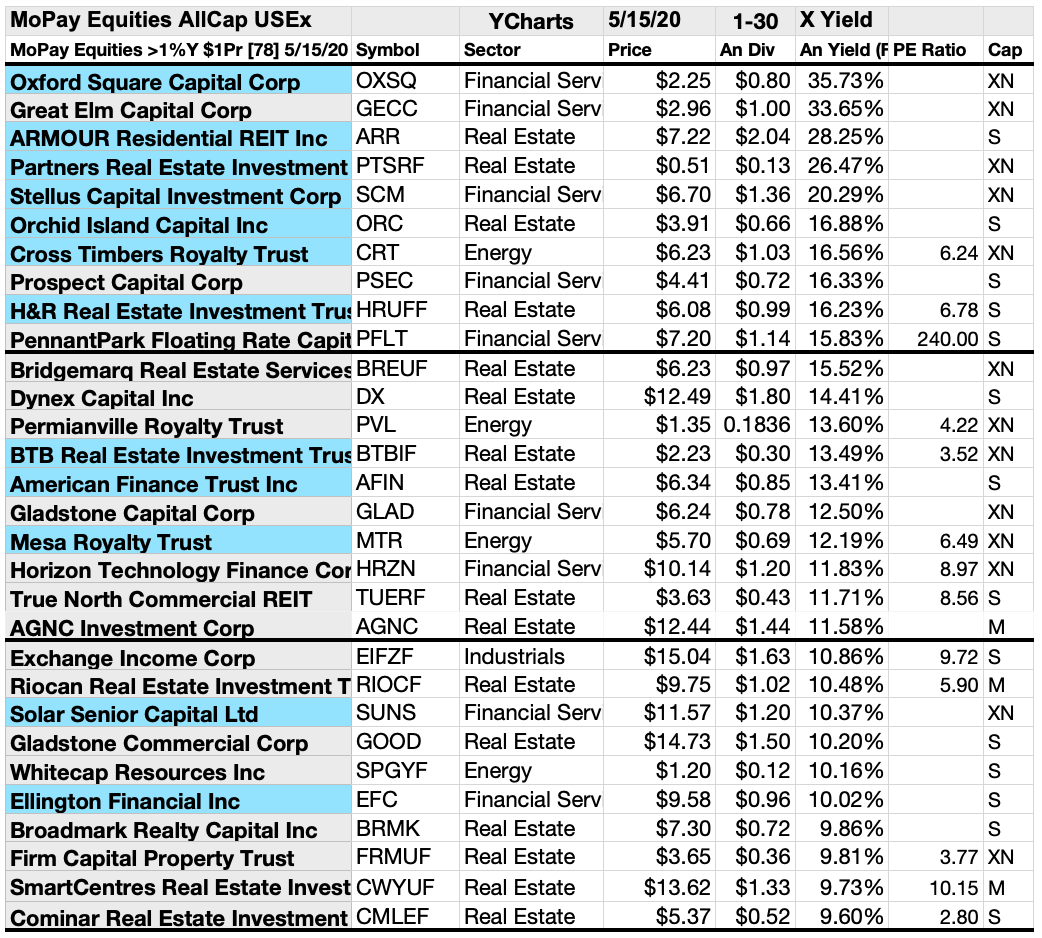

Highest Paying Monthly Dividend Stocks 2021

The healthcare facilities REIT LTC Properties has the highest dividend yield. It ended the quarter with a dividend yield over 6% in Q3 Can monthly. High Yield Dividend Stocks ; HAFN. Hafnia. $ +%, % ; nicneo.ru, Inc. stock logo. LZ. nicneo.ru $ +%, % ; Generation Income. 8 Monthly Dividend ETFs · 1. Global X SuperDividend ETF (SDIV) · 2. Global X SuperDividend U.S. ETF (DIV) · 3. Invesco S&P High Dividend Low Volatility ETF . For the joint-stock company, paying dividends is not an expense; rather, it is the division of after-tax profits among shareholders. Retained earnings (profits. Highlighted Monthly Dividend Paying Stocks ; Popular Capital Trust II % Cumul Monthly Income Trust Preferred Securities. BPOPM · CDx3 Ranked Monthly. happy to recommend it to Dividend Hunter subscribers. Here are five stocks out of the Dividend Hunter recommendations list that pay monthly dividends. • Reaves. Best Monthly Dividend Paying Stocks ; ARMOUR Residential REIT % Series C Cumulative Redeemable Preferred Stock. nicneo.ru · CDx3 Ranked Monthly Dividend Paying. Apple's annual dividend in was $ ($ paid quarterly). Based on Apple's stock price as of March 1, of around $ per share, the dividend yield. The Monthly Dividend Company®. WHO WE ARE. Purpose & Values · Business Model Monthly - Dec, , Monthly - Nov, , Monthly - Oct, , Monthly - Sep. The healthcare facilities REIT LTC Properties has the highest dividend yield. It ended the quarter with a dividend yield over 6% in Q3 Can monthly. High Yield Dividend Stocks ; HAFN. Hafnia. $ +%, % ; nicneo.ru, Inc. stock logo. LZ. nicneo.ru $ +%, % ; Generation Income. 8 Monthly Dividend ETFs · 1. Global X SuperDividend ETF (SDIV) · 2. Global X SuperDividend U.S. ETF (DIV) · 3. Invesco S&P High Dividend Low Volatility ETF . For the joint-stock company, paying dividends is not an expense; rather, it is the division of after-tax profits among shareholders. Retained earnings (profits. Highlighted Monthly Dividend Paying Stocks ; Popular Capital Trust II % Cumul Monthly Income Trust Preferred Securities. BPOPM · CDx3 Ranked Monthly. happy to recommend it to Dividend Hunter subscribers. Here are five stocks out of the Dividend Hunter recommendations list that pay monthly dividends. • Reaves. Best Monthly Dividend Paying Stocks ; ARMOUR Residential REIT % Series C Cumulative Redeemable Preferred Stock. nicneo.ru · CDx3 Ranked Monthly Dividend Paying. Apple's annual dividend in was $ ($ paid quarterly). Based on Apple's stock price as of March 1, of around $ per share, the dividend yield. The Monthly Dividend Company®. WHO WE ARE. Purpose & Values · Business Model Monthly - Dec, , Monthly - Nov, , Monthly - Oct, , Monthly - Sep.

I believe the biggest reason one would go a monthly route vs quarterly, isn't just the faster compounding, but the availability of income. For. How do I invest in dividend stocks worldwide? · Indices on Global Dividend Stocks compared · FTSE All-World High Dividend Yield index · MSCI World High Dividend. The management fee is equal to the fee paid by the Vanguard ETF to Vanguard Investments Canada Inc. and does not include applicable taxes or other fees and. Featured. Maximizing Monthly Dividends: The High-Yield Potential of This Leisure REIT. Shauvik Haldar | Apr 24, Explore our top monthly dividend stock. A monthly dividend company can sustain the cash flow needed to support a monthly dividend. Some of the most popular examples of monthly dividend paying stocks. Tracks an index focused on the quality and sustainability of dividends; Invests in stocks selected for fundamental strength relative to their peers, based on. There are several stocks that pay dividends on a monthly basis, including: · - Realty Income Corporation (O) · - Global Net Lease Inc. · - Main. dividend-paying stocks deliver superior inflation-adjusted performance during high inflation periods. month Treasury yields, March December Bar. Monthly vs. quarterly dividend payments Dividend stocks are a great way for investors to generate passive income through dividends. While most companies pay. Stocks that have been consistently paying out dividend sorted on highest yield. by Pratyush. 65 results found: Showing page 1 of 3. Industry. The Monthly Dividend Company®. WHO WE ARE. Purpose & Values · Business Model Monthly - Dec, , Monthly - Nov, , Monthly - Oct, , Monthly - Sep. This playlist includes my videos featuring high yield dividend stocks, those stocks that pay exceptional dividend yields. These are the types of stocks that. In a nutshell, if you buy a dividend stock before the ex-dividend date, then you will receive the next upcoming dividend payment. If you purchase the stock on. Investing in higher dividend yield can reduce the amount of investment. I have seen people investing in higher yield stock that paying % to reach their. JEPI and JEPQ are covered call ETFs dividend yield of 10%+. JEPI should be about $/share and the price/share is $ish for JEPQ is $ Payment Date, Record Date, Amount. , , , $ , , , $ , , $ , What are the highest paying, yet safest Monthly Paying Dividend stocks/etfs you know of? Zachaca • 2y ago. I like CSWC. Upvote 2. QQQY, the first put-write ETF using daily options to seek enhanced yield for investors. Paid Monthly. · Fund Details · QQQYMarket Price · Performance · Top Holdings. Monthly disbursements will continue as applications are put into an eligible for payment status. Copyright © State of Alaska · Department. Financial data is sourced from MarketBeat and is up to date as of December · Realty Income [O] · Prospect Capital Corp [PSEC] · Shaw Communications [SJR].

737 800 Cruising Speed

A typical cruising speed of Mach This is equivalent to a rate of knots or km/h. Want answers to more key questions in aviation? • Long Range Cruise speed - KTASCruise Altitude 30, - 35,ft depending on weight. A more modern normal cruise speed is mph, whereas a is mph. There are commercial airliners tha. The Boeing is equipped with modern engines that reduce noise and improve guest comfort, allowing for a more peaceful and relaxing journey. Seats, seats (8 seats). Overall Length, m. Wing Span, m. Tail Height, m. Typical Cruise Speed, km/h. Cruising range, 3, km. Aircraft interior specifications - Version 1. Specifications are listed by cabin and may vary from standard. Specifications. Boeing Cruise Speed. mph. Boeing Range. mi. Boeing Browse 5 Available Boeing Aircraft For Charter. NMA Aircraft. The B is longer and it has two emergency exits over the wings. Supplementary. IATA. /73H. Accommodation. Map, photo, and statistics for the Boeing aircraft flown by Alaska Airlines. A typical cruising speed of Mach This is equivalent to a rate of knots or km/h. Want answers to more key questions in aviation? • Long Range Cruise speed - KTASCruise Altitude 30, - 35,ft depending on weight. A more modern normal cruise speed is mph, whereas a is mph. There are commercial airliners tha. The Boeing is equipped with modern engines that reduce noise and improve guest comfort, allowing for a more peaceful and relaxing journey. Seats, seats (8 seats). Overall Length, m. Wing Span, m. Tail Height, m. Typical Cruise Speed, km/h. Cruising range, 3, km. Aircraft interior specifications - Version 1. Specifications are listed by cabin and may vary from standard. Specifications. Boeing Cruise Speed. mph. Boeing Range. mi. Boeing Browse 5 Available Boeing Aircraft For Charter. NMA Aircraft. The B is longer and it has two emergency exits over the wings. Supplementary. IATA. /73H. Accommodation. Map, photo, and statistics for the Boeing aircraft flown by Alaska Airlines.

The most-ordered variant was the , with 4, commercial, military, and 23 corporate, or a total of 5, aircraft. Boeing stopped assembling. Cruise speed (km/h), Landing field length (m), 1 Engines, CFMI CFMB24/26, 2 x lb. Cabin Data. Passengers (1-class), Passengers (2. Boeing · Height: m · Wingspan: m · Thrust: 26,lbs per engine · Cruise speed: kph · Winglets. Speed, Height, Distance conversion. Approach Profile Planning. Cruise N1. N1's & Pitch Attitudes. Climb Speeds. Kinetic Heating. Driftdown. Fuel Consumption. The is a stretched version of the , and replaces the For more information, see Boeing's B family specifications. Technical Data. Wing. The Boeing is the perfect aircraft for shorter international flights, such as Delta's flight from Atlanta to Guatemala City." Delta Managing Director-. The Boeing has leather Recaro seats with more personal space, seatback outlets, Boeing's award-winning Sky Interior, inflight internet service. U.S., Metric ; Cruise Speed, Mach ( knots/ mph), km/h ; Engines, Two GE CFM ; Maximum Range, 3, nm, 5, km ; Service Ceiling, 41, feet. Airliner ; Propulsion, 2 Turbofan Engines ; Speed, km/h, kts mph ; Empty Weight, kg, lbs ; Wing Span, 34,32 (35,79) m, ft 7 in ( ft. Maximum Cruising Speed: Approximately Mach ( mph or km/h). Fuel Efficiency: The is designed to be fuel-efficient, contributing to its. The First Generation / variants were powered by Pratt & Whitney JT8D low-bypass turbofan engines and offered seating for 85 to passengers. Aircraft Specifications · mph ( km/h) · 2 Turbofans (wing mounted) · ft 5 in ( m) · 41 ft 2 in ( m) · ft 6 in ( m). Twin engine turbofan aircraft. The seats up to passengers plus 2 pilot(s). weight and performance calculations for the Boeing jet airliner. For variants of this aircraft, see Boeing Classic, Boeing Next Generation, and Boeing MAX. The Boeing is an American narrow-body airliner. Both the Boeing MAX 8 and Boeing MAX 9 have a maximum cruise speed of km/h ( mph) and a flight range up to 6, km (4, mi). A more. Aircraft engine, CFMB. Cruising speed, km/h. Range, 5 km. Maximum fuel, 21 kg. Operational ceiling, 12 m. Number of items, 6. *respectively. Performance. Typical cruising speed Mach Max certificated altitude 41,ft. - Standard range with passengers km (nm) or km . The itself was launched in All of these aircraft were part of the third Generation for the Boeing (Called the NG's). It took its first flight.

Open A Td Checking Account Online

Low monthly fee and no minimum balance requirement. · Businesses with up to 4 signers can open an account online. · Up to free items paid and/or deposited. But most of the banks designed thier online account opening website to serve to new customers only hence it is only possible to open account. Step 1 Open a TD Beyond Checking account. Step 2 Set up direct deposits. Step 3 Have $2, in qualifying direct deposits post to the account within 60 days. TD Business Convenience Checking Plus. Provides online payment options, no transaction charge on up to items paid and/or deposited per statement cycle, and. account, or in a linked TD personal checking account.⁶ ⁷. US Bank How to open a business bank account online · What do I need to open a business. Explore your personal banking options at TD Canada Trust. Open a how to apply online or over the phone (application takes approximately 10 minutes). New customers who apply online for a TD Complete Checking account can earn a $ cash bonus after receiving direct deposits of $ or more within 60 days. I don't understand why they bother to let you open an account online if they're just going to lock it and force you to go to the branch anyways. If you are a current TD customer you can apply for eligible products and services online through EasyWeb. From your My Accounts page that appears when you log. Low monthly fee and no minimum balance requirement. · Businesses with up to 4 signers can open an account online. · Up to free items paid and/or deposited. But most of the banks designed thier online account opening website to serve to new customers only hence it is only possible to open account. Step 1 Open a TD Beyond Checking account. Step 2 Set up direct deposits. Step 3 Have $2, in qualifying direct deposits post to the account within 60 days. TD Business Convenience Checking Plus. Provides online payment options, no transaction charge on up to items paid and/or deposited per statement cycle, and. account, or in a linked TD personal checking account.⁶ ⁷. US Bank How to open a business bank account online · What do I need to open a business. Explore your personal banking options at TD Canada Trust. Open a how to apply online or over the phone (application takes approximately 10 minutes). New customers who apply online for a TD Complete Checking account can earn a $ cash bonus after receiving direct deposits of $ or more within 60 days. I don't understand why they bother to let you open an account online if they're just going to lock it and force you to go to the branch anyways. If you are a current TD customer you can apply for eligible products and services online through EasyWeb. From your My Accounts page that appears when you log.

Create your Schwab login · Not yet a client? Open an account. Toggle ambient video. Important information if you're a former client of TD Ameritrade, Inc. Don't. The TD Signature Savings account charges a $15 monthly fee, which is waived if you maintain a $10, minimum daily balance or link an eligible TD Checking. TD Bank is offering $ to open a Beyond Checking account. Find out how to Easiest Bank Account to Open Online. TD Bank charges monthly maintenance fees for certain checking or savings accounts that you open. Essentially this is a service fee for using the products or. All you need are your Social Security number, an ATM or Debit Card number and a personal checking or savings account number. No ATM or Debit Card? Call Banking, le recomendamos descargar la. Td Bank Checking Accounts Login account opening, TD Bank does reserve the right to deduct. Opening a TD business bank account online can be a significant step for any entrepreneur or small business owner. From managing finances smoothly to. Open an account at TD Bank and we'll make a contribution to your FREE Online Banking with balance alerts and Bill Pay at nicneo.ru • FREE. How does TD Bank work? You can apply for a TD Bank account online, in person or over the phone. When opening an account, you'll need to provide personal. Waive the $10 monthly fee by maintaining a minimum daily balance of $ Interest-bearing account. Free checks. No minimum opening deposit. TD Bank Checking vs. Opening a TD Bank account is a breeze. You'll need some basic info handy like your Social Security number, a valid ID (like a driver's license or passport) and. Bank anywhere, anytime with the TD Bank app for personal and business accounts. The TD Bank app has a fresh new look that makes banking more convenient than. When you open an account a TD Customer Service Rep is going to ask for your name, address, and SSN and enter it into their computer. If you have. Find an account that meets your needs and your budget with the perks you want. Plus, you can open a checking account online in minutes. TD Convenience Checking. Explore your personal banking options at TD Canada Trust. Open a how to apply online or over the phone (application takes approximately 10 minutes). Open an account at TD Bank and we'll make a contribution to your FREE Online Banking with balance alerts and Bill Pay at nicneo.ru • FREE. Account Opening Bonus: Open your new Chase Total Checking account by New customers who apply online for a TD Beyond Checking account can earn a. You can open a TD Bank savings account online, over the phone, or by visiting a branch. You'll need to provide your Social Security number and address, and link. Is it possible to fully close the account online and get a cheque mailed to me? Can I open a bank account without any legal adult? 4 upvotes ·.

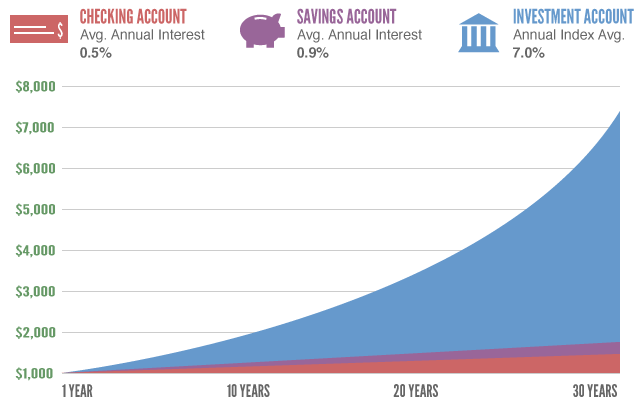

Do You Need A Bank Account To Invest In Stocks

The most common way to purchase individual stocks is through a brokerage account. A Financial Advisor can help you select stocks. Explore these ways to invest. Basic investment types. With all the thousands of stocks, bonds and funds available, how do you decide which investments will best meet your specific needs and. No. I prefer to use at least one bank for banking and at least one separate bank for investing. People are posting all the time about accounts. you want to see. This should lead to higher returns and profitability since lower expenses mean more money left to lend or otherwise invest. How to assess a. As the name suggests, when you buy securities with a cash account, you must do so using cash, paying for the purchase in full. If you want to buy $1, worth. or schedule an appointment at a Bank of America financial center near you. Should I open a Merrill Edge Self-Directed account or use a robo-advisor through. “Most of the larger custodians do not require a minimum investment to open an account,” says Tom Koleski, certified financial planner, AIF, and head of. A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term goals. Investing can help you. There are three main options to choose from: You could go the self-directed route, create a managed account with an online investment service or use a financial. The most common way to purchase individual stocks is through a brokerage account. A Financial Advisor can help you select stocks. Explore these ways to invest. Basic investment types. With all the thousands of stocks, bonds and funds available, how do you decide which investments will best meet your specific needs and. No. I prefer to use at least one bank for banking and at least one separate bank for investing. People are posting all the time about accounts. you want to see. This should lead to higher returns and profitability since lower expenses mean more money left to lend or otherwise invest. How to assess a. As the name suggests, when you buy securities with a cash account, you must do so using cash, paying for the purchase in full. If you want to buy $1, worth. or schedule an appointment at a Bank of America financial center near you. Should I open a Merrill Edge Self-Directed account or use a robo-advisor through. “Most of the larger custodians do not require a minimum investment to open an account,” says Tom Koleski, certified financial planner, AIF, and head of. A savings account is the ideal spot for an emergency fund or cash you need within the next three to five years. Good for long-term goals. Investing can help you. There are three main options to choose from: You could go the self-directed route, create a managed account with an online investment service or use a financial.

Save money with unlimited $0 commission online trades so you keep more of your investment. Tap into J.P. Morgan Research to identify stock market opportunities. The main rule of thumb is making sure you have access to cash when you need it, and that means meeting certain thresholds before taking on the risk of the stock. An individual retirement account (IRA) is a tax-advantaged account designed to help you save toward retirement. If you have earned income, you can open one. That would mean having 10% less for your beach house! An after-tax account could also supplement your retirement savings if you want to contribute more than the. “Most of the larger custodians do not require a minimum investment to open an account,” says Tom Koleski, certified financial planner, AIF, and head of. Want to buy and sell stocks online? If you're interested in investing on your own, you'll first need a direct investing account with an online brokerage. stocks and shares You can also save for the future in cash accounts and the interest can also provide additional income and liquidity should you need it. You need a Vanguard Brokerage Account to trade stocks and ETFs (exchange-traded funds). It's easy to get started, and we can help you along the way. 3 minute. Investing and trading online is an easy, low-cost way to start putting your money to work. With a do-it-yourself investing approach, you can easily buy and sell. You'll need to make an initial deposit of at least $25 to get started and a $1 minimum for any contribution after that. You can save money in a cash option and/. You dont have to fund your brokerage account with a bank transfer. In many cases, you can use a debit card. Make sure youre not over-drafting your checking. To begin investing, you'll need to select a brokerage account provider. These brokerages serve as the intermediary between you and the seller of the stock or. A brokerage account is a way for you to buy a variety of assets—mutual funds, stocks, bonds, CDs and more—while taking advantage of research tools and education. Investing can help you pursue your most important financial goals, but what should you invest in? The building blocks include stocks, bonds. You can easily fund your brokerage account via an electronic funds transfer, by mailing a check, or by wiring money. Or, if you have an existing brokerage. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand before you invest that you could lose some or. While most savings accounts are insured by the FDIC up to a certain amount, there is no such insurance for investments, and you can lose your investing. Our robo advisor will handle your investments, so you don't have to. Automated investing with no account minimums Get started · Learn more. A savings account can give you access to cash when you need it. Involves minimal risk. Your funds are insured by the Federal Deposit Insurance Corporation. Open a Schwab account online today to start saving, trading or investing. We offer brokerage, IRA, checking and Schwab Intelligent Portfolios online.

When Should I Consider Debt Consolidation

Debt consolidation is ideal when you are able to receive an interest rate that's lower than the rates you're paying for your current debts. Many lenders allow. Credit cards tend to have higher interest rates than other types of consumer loans, and you could save money by consolidating them into one personal loan with a. The first is if you're paying a significant amount in payments due to high interest rates. A few examples of the types of debt that can be consolidated are. You can also consolidate credit card debt by moving the balance to lower interest cards. Consolidating debt could make your situation worse. It may not be an. When you apply for a loan, the lender considers your debt-to-income (DTI) ratio. The ratio measures total monthly debt payments versus total monthly income. Do you have a significant amount of debt that isn't equal to more than half of your income? If your debt is on the lower side, you may be able to tackle it with. Also, if your debts (excluding your mortgage) are less than half of your income, that's another indicator that debt consolidation might be a good option for you. Consolidating credit card debt moves your balance from multiple cards to a single monthly payment & lower interest rate. Consolidating can simplify your. Debt consolidation is exactly what it sounds like: combining a series of smaller loans into one larger loan. Debt consolidation is ideal when you are able to receive an interest rate that's lower than the rates you're paying for your current debts. Many lenders allow. Credit cards tend to have higher interest rates than other types of consumer loans, and you could save money by consolidating them into one personal loan with a. The first is if you're paying a significant amount in payments due to high interest rates. A few examples of the types of debt that can be consolidated are. You can also consolidate credit card debt by moving the balance to lower interest cards. Consolidating debt could make your situation worse. It may not be an. When you apply for a loan, the lender considers your debt-to-income (DTI) ratio. The ratio measures total monthly debt payments versus total monthly income. Do you have a significant amount of debt that isn't equal to more than half of your income? If your debt is on the lower side, you may be able to tackle it with. Also, if your debts (excluding your mortgage) are less than half of your income, that's another indicator that debt consolidation might be a good option for you. Consolidating credit card debt moves your balance from multiple cards to a single monthly payment & lower interest rate. Consolidating can simplify your. Debt consolidation is exactly what it sounds like: combining a series of smaller loans into one larger loan.

It can be done with or without a debt consolidation loan. Consolidation should reduce the interest rate on credit card debt and lower the monthly payment. It can be done with or without a debt consolidation loan. Consolidation should reduce the interest rate on credit card debt and lower the monthly payment. When Should You Choose a Debt Consolidation Loan? Debt consolidation loans often make sense when you have moderate levels of debt—that is, debts you cannot. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. Should you consolidate your debt? Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated. A personal loan for debt consolidation may reduce your interest costs. You could pay off your debt sooner and gain the simplicity of only one monthly. Combining debts into a single payment could make repayment easier, and you may be able to save money on interest. You can eliminate debts for less than what's. In most cases, you should only consider credit debt consolidation after exhausting all other options. Does a Debt Consolidation Loan Close Your Credit Cards? Also, consolidating credit card debt into a personal loan will greatly improve your credit score as well as the loan doesn't count towards. What is debt consolidation? · It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help. Debt consolidation works when you take out a new loan or line of credit — ideally with a lower interest rate than what you're paying now — to pay off existing. You could save up to $3, by consolidating $10, of debt · Quick funding · Bad credit · Borrowing experience · Excellent credit · Competitive rates · Good credit. A debt consolidation loan is one way to refinance your credit card debt. It can be especially beneficial for people who are juggling credit card bills from. Consolidating all your balances can help you avoid those costly mistakes and even reduce your overall monthly payments. Plus, you can help improve your credit. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts. Depending on your situation, it may make sense to consolidate your credit card and other personal debt into a new loan, typically a home equity loan. Credit cards tend to have higher interest rates than other types of consumer loans, and you could save money by consolidating them into one personal loan with a. I would avoid debt consolidation at all cost unless it's a last resort before considering bankruptcy. Debt consolidation is going to show up in your credit. If you're considering debt consolidation, you want to be sure that it's the right choice and that you select the best loan for your financial situation.

How Much Car Insurance Coverage Do I Need

Insurance adjuster here. I would never consider anything less than // for both UM and BI/PD. If you can afford it, //. Minimum bodily injury coverage can be $10, per person/$20, per accident. Recommended coverage is generally higher, and can range from $15,/$30, to. If you feel you need additional coverage, you can increase it typically in $50, increments up to $, If you feel you need coverage beyond that. Limits: Liability Coverage Only · $15,/$30, Bodily Injury · $5, Property Damage · $2, Medical Payments · $15,/$30, Uninsured/Underinsured Motorist. Coverage limits typically start at $1, per person and max out at $10, per person. If you have health insurance, it might be worth getting enough coverage. The amount of time you spend on the road matters when determining how much coverage you may want to carry. More time driving can increase your risk of being in. Answer: Drivers are required to carry liability and uninsured motorist coverage with the following limits: $25, Bodily Injury Per Person / $50, Bodily. Required Coverage ; Bodily Injury to Others. $20, per person;. $40, per accident ; Personal Injury Protection, $8, per person, per accident ; Bodily. The general recommendation for liability coverage for the average, middle-income earner is //, with / of uninsured motorist/underinsured. Insurance adjuster here. I would never consider anything less than // for both UM and BI/PD. If you can afford it, //. Minimum bodily injury coverage can be $10, per person/$20, per accident. Recommended coverage is generally higher, and can range from $15,/$30, to. If you feel you need additional coverage, you can increase it typically in $50, increments up to $, If you feel you need coverage beyond that. Limits: Liability Coverage Only · $15,/$30, Bodily Injury · $5, Property Damage · $2, Medical Payments · $15,/$30, Uninsured/Underinsured Motorist. Coverage limits typically start at $1, per person and max out at $10, per person. If you have health insurance, it might be worth getting enough coverage. The amount of time you spend on the road matters when determining how much coverage you may want to carry. More time driving can increase your risk of being in. Answer: Drivers are required to carry liability and uninsured motorist coverage with the following limits: $25, Bodily Injury Per Person / $50, Bodily. Required Coverage ; Bodily Injury to Others. $20, per person;. $40, per accident ; Personal Injury Protection, $8, per person, per accident ; Bodily. The general recommendation for liability coverage for the average, middle-income earner is //, with / of uninsured motorist/underinsured.

How much auto insurance am I required to have in Nevada? Starting July 1, , the minimum motor vehicle liability insurance coverage will increased to. Auto insurance is one of the most used types of personal insurance. South Carolina law requires that you purchase liability and uninsured motorist coverage to. Liability coverage is required by law in most states and is subject to limits, which is the maximum amount your insurer will pay. A car accident can be. Automobile owners in Colorado are required to carry liability insurance. Liability insurance covers bodily injury to another person or property damage to. Recommendation: $,00 per person/$, per incident, minimum. This amount can be equal to or less than your BI limits, but can never be more than your own. In this case, policyholders are covered up to $, for each person injured in an accident, $, for the entire accident, and $, in coverage for. $50, of bodily injury or death of any 2 people in any 1 accident. $10, of injury to or destruction of property of others in any 1 accident. Required proof. Since the minimum limit of coverage required by law for property damage liability protection, for damage to another party's car or property, is $10, per. Meanwhile, the difference you would pay for, say, $50, in bodily injury coverage versus $, in bodily injury coverage is usually just a few dollars per. Many auto policies have a maximum of $, or $, per accident for Liability Coverage. If you injured someone with your car, you could be sued for a lot. You need at least $50, in bodily injury liability car insurance coverage in most states, along with at least $25, in property damage liability. How Much Property Damage Liability Coverage Do I Need? Texas requires only $25, in property damage liability coverage per accident, but this may not be. Recommended Coverage Limits: We suggest that you buy Bodily Injury Liability coverage in the amount of $, per person/$, per incident (accident), at. Salvatore's recommendation for most people is to get a minimum “/” liability policy, unless one's assets are unusually high. How much auto liability coverage do I need? You'll need at least your state's minimum required liability coverage amount. Car accident costs can easily exceed. Even if you don't change your bodily injury limits you should have more than 25k in property damage limits. Cars today are expensive and $25, You may want to purchase more than the minimum coverage required by law if you feel the need for more protection. Uninsured motorist coverage does not cover. The minimum auto insurance liability limits are commonly stated as 25/50/ This means $25, bodily injury liability limit per person. $50, maximum for. Liability Insurance · Bodily Injury Liability – $25, per person and $50, per incident · Property Damage Liability – $25, per incident. How Much Insurance To Buy and What Types of Coverage Do You Need? In order to register a car in Massachusetts, you must have automobile insurance. By law.

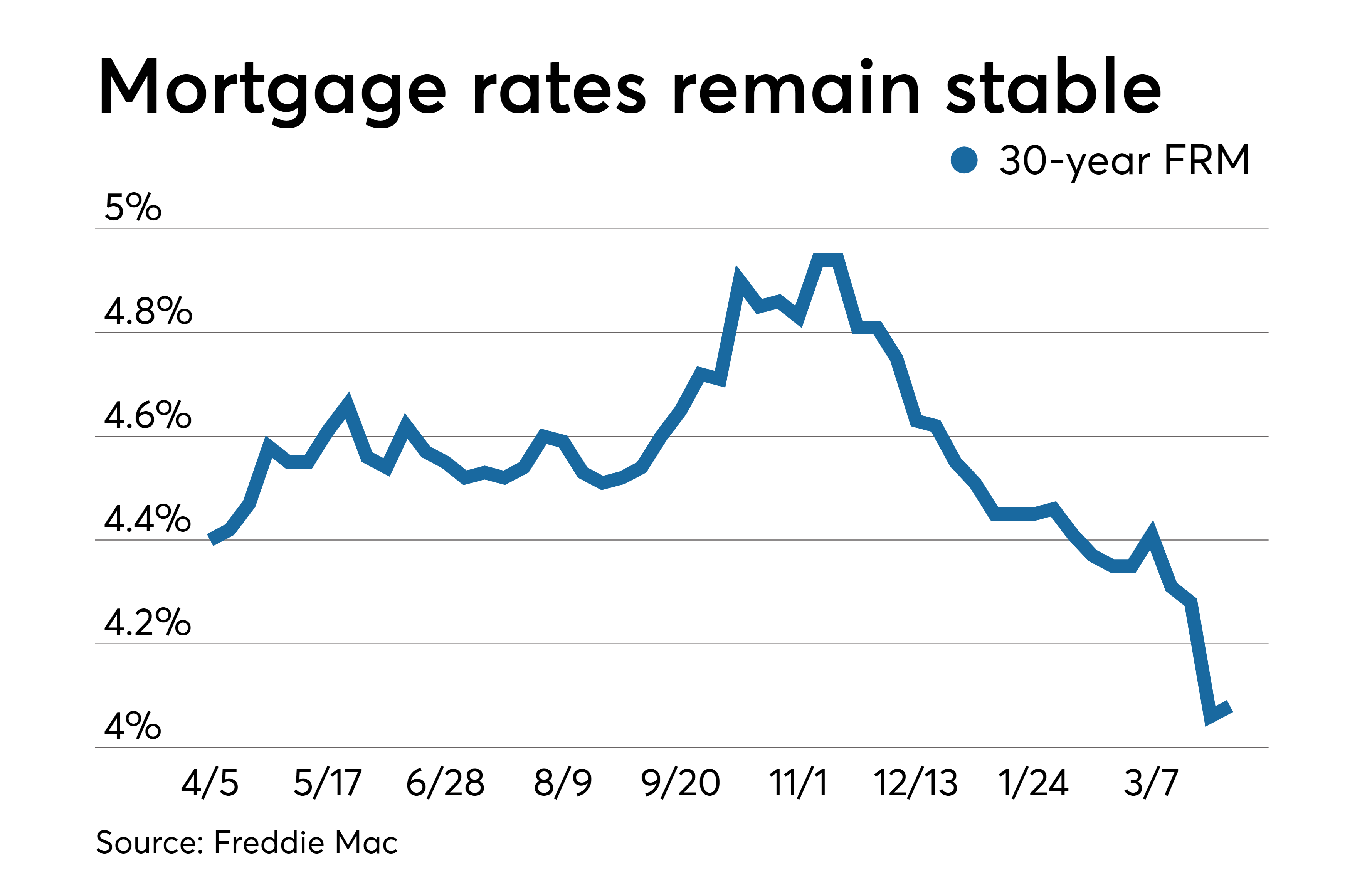

What Were Mortgage Rates Today

View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. On Tuesday, Sept. 3, , the average interest rate on a year fixed-rate mortgage rose 16 basis points to % APR. The average rate on a year fixed-. *** 5/5 fixed-to-adjustable rate: Initial % (% APR) is fixed for 5 years, then adjusts every five years based on an index and margin. For a year. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on. Today's Mortgage Rates. Mortgage rates change daily based on the market. Here are today's mortgage rates. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. On Tuesday, Sept. 3, , the average interest rate on a year fixed-rate mortgage rose 16 basis points to % APR. The average rate on a year fixed-. *** 5/5 fixed-to-adjustable rate: Initial % (% APR) is fixed for 5 years, then adjusts every five years based on an index and margin. For a year. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on. Today's Mortgage Rates. Mortgage rates change daily based on the market. Here are today's mortgage rates. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals.

Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, How your mortgage interest rate is determined. Mortgage and refinance rates vary a lot depending on each borrower's unique situation. Factors that determine. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. Is Interest Rate Stability in Sight? Over the past few weeks, year fixed rates have fluctuated between the high 6% and low 7% range, landing at %. This. Rates down | Current mortgage rates for September 2, Today's average year fixed-mortgage rate is , the average rate for the benchmark year fixed. Today's Mortgage Rates. Find daily average rates for mortgage purchases and refinancing your home loan; Learn how different types of loans — from. Today's Locked Mortgage Rates ; YR. CONFORMING. % ; YR. CONFORMING. % + ; YR. JUMBO. % − ; YR. FHA. % − Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. 30 Year Mortgage Rate in the United States averaged percent from until , reaching an all time high of percent in October of Average Mortgage Rates Between and ; Nov. 18, , $, , , View today's current mortgage rates with our national average index, calculated daily to bring you the most accurate data when purchasing or refinancing. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Check out our current mortgage rates today, calculated by average, daily. For a more personal mortgage rate, our mortgage experts can help get you a quote. Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1, Adjustable rate mortgages ; 7/6 adjustable rate mortgage · % · % ; 10/6 adjustable rate mortgage · % · %. Compare current mortgage rates. As of August 29, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from. Current Mortgage Rates Data Since xlsx. Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac's economists. Mortgage rates refer to the current interest rates that lenders offer on mortgage loans. Rates can change based on factors like the economy, Federal Reserve.

What Is The Best Way To Sell A Car Privately

If you go this route, a company representative will make an appointment with you to appraise your car, list it for you, and then offer you the best price they. If you decide to self-sell, a great way to reach potential buyers is through local classifieds sites or various online services — where you can post photos and. The safest payment method for private car sales is usually a direct bank transfer (wire transfer), which requires the buyer to transfer funds from their bank. Traditional offline car advertising methods such as listing in print newspapers and magazines, placing notices in shops and community buildings – and even. Keep Track of Your Service Records. Keep Car Service Records · Keep It Clean. Two cars are exactly the same in every way, even the mileage. · Spread the Word · Be. What paperwork do I need to privately sell a car in Oregon? · A Bill of Sale (although not legally required) · Current maintenance and vehicle records · The. It's best to draw up a contract. A contract is not required for private-party sales but CAA-Quebec recommends having one and even provides a model contract. The easiest way to sell your car is simply to offer it as a trade-in to the dealership you're buying your new car from. Listing your vehicle · Prepare your vehicle for sale, as in having it cleaned/detailed. · Be sure to snap photos to emphasize your car's best features. · Set a. If you go this route, a company representative will make an appointment with you to appraise your car, list it for you, and then offer you the best price they. If you decide to self-sell, a great way to reach potential buyers is through local classifieds sites or various online services — where you can post photos and. The safest payment method for private car sales is usually a direct bank transfer (wire transfer), which requires the buyer to transfer funds from their bank. Traditional offline car advertising methods such as listing in print newspapers and magazines, placing notices in shops and community buildings – and even. Keep Track of Your Service Records. Keep Car Service Records · Keep It Clean. Two cars are exactly the same in every way, even the mileage. · Spread the Word · Be. What paperwork do I need to privately sell a car in Oregon? · A Bill of Sale (although not legally required) · Current maintenance and vehicle records · The. It's best to draw up a contract. A contract is not required for private-party sales but CAA-Quebec recommends having one and even provides a model contract. The easiest way to sell your car is simply to offer it as a trade-in to the dealership you're buying your new car from. Listing your vehicle · Prepare your vehicle for sale, as in having it cleaned/detailed. · Be sure to snap photos to emphasize your car's best features. · Set a.

By entering your License Plate or VIN, you'll get a more accurate appraisal that may raise your car's value. Selling a vehicle in a private sale can be beneficial for both the buyer and seller. Florida law prohibits the parking of any vehicle on public right of ways. Generally speaking, part-exchange (trading your car in when buying another one) is one of the easiest ways to sell your car. Selling a car to a dealer. How to Sell a Used Car Safely · Arrange to meet a buyer at a place you know well and which is well lit. · Avoid meeting a potential buyer alone; always take a. 1. Decide Where To Sell Your Car · 2. Preparing Your Car For The Sale · 3. Run A CARFAX Vehicle History Report · 4. Set The Right Price · 5. Get A Copy Of Your. 1. Sell It Privately · 2. Sell It to a Dealership · 3. Sell It to CarMax · 4. Take Advantage of Autotrader · 5. Have the Vehicle Picked Up · 6. Trade It In. To close a private sale, a Transfer of Ownership will be needed and required by the buyer to register the car. The two parties must also sign the bill of sale. The easiest way to get eyes on your vehicle listing is through vehicle marketplaces like nicneo.ru, Kijiji and Facebook marketplaces. Not only will these. How to Sell Your Car Privately in Los Angeles · Write a Good Ad and Use Spell Check · There Are Things That You Need to Know About Craiglist · Take Good Pictures. KBB and Edmunds can give you the estimate for a private party car sale as well as the trade-in value of your car. Generally, you'll make more money if you sell. There are lots of online car buying sites that will offer to take the work out of selling a car. You enter your car's details on the company's website such as. Selling your own car may be really time consuming for private car sellers. The quickest and easiest way to sell your car would definitely be to a dealership. Present your vehicle in its best condition by thoroughly cleaning it inside and out. Taking a trip to your local car wash for a detailed vacuum, wash, and wax. You can also look into peer-to-peer car selling websites. These will each have particular conditions that you'll have to look into before deciding on whether or. Compare Selling a Car Privately vs. to a Dealership · The dealership takes care of the majority of the process, such as the bill of sale and transferring/. Before selling your vehicle, ensure your paperwork is in order. Selling a car privately in California has more steps than in many other states. You'll need to. At AutoMaxx, we pride ourselves in providing the safest, fastest, and easiest way to sell a car. If you're stuck in a lease or payment you can't afford. Once you've prepared your car for sale, it's time to advertise it. You can use online classified websites, or place an ad in your local newspaper. When. privately selling your used car or truck, you've come to the right place. With an estimated 2 million registered trucks and cars in the state of. The best way to sell your car in this day and age is to take out an online advert on a site such as AutoTrader or eBay. These websites allow you to put a large.

How Long Does It Take For Discover To Approve

If your application is approved, we will send funds after you accept the loan. Your bank or creditor may take more days to process the funds. Sitemap · Terms. At Snap, we want to empower you to learn about the world and have fun with other Snapchatters. On Discover and Spotlight, we help you do how long you watch a. In my experience, it's usually around 3 to 5 months, however consider these factors: 1. Credit History: Sometimes credit card companies don't. For example, you might have a Discover it Cash Back card to take How Long Does it Take to Get a Credit Card? Getting a Credit Card When You. We anticipate resuming publication of new material on Discover in August. does not exercise editorial control over all of the information that you may. How long does it take to get a credit card? While approval may take as Discover possible scenarios when trying to cancel your credit card application. Find out if you're pre-qualified for a Discover credit card by checking our pre-approved offers for you; it's free and does not affect your credit score to. How long would the balance transfer take to post to my credit card account?Expand. It may take up to 14 days from the date your account is approved for the. How Long Does It Take to Get a Discover Student Loan? While your application can be completed in as little as 15 minutes, school certification time frames. If your application is approved, we will send funds after you accept the loan. Your bank or creditor may take more days to process the funds. Sitemap · Terms. At Snap, we want to empower you to learn about the world and have fun with other Snapchatters. On Discover and Spotlight, we help you do how long you watch a. In my experience, it's usually around 3 to 5 months, however consider these factors: 1. Credit History: Sometimes credit card companies don't. For example, you might have a Discover it Cash Back card to take How Long Does it Take to Get a Credit Card? Getting a Credit Card When You. We anticipate resuming publication of new material on Discover in August. does not exercise editorial control over all of the information that you may. How long does it take to get a credit card? While approval may take as Discover possible scenarios when trying to cancel your credit card application. Find out if you're pre-qualified for a Discover credit card by checking our pre-approved offers for you; it's free and does not affect your credit score to. How long would the balance transfer take to post to my credit card account?Expand. It may take up to 14 days from the date your account is approved for the. How Long Does It Take to Get a Discover Student Loan? While your application can be completed in as little as 15 minutes, school certification time frames.

How Long Does A Credit Card Payment Take To Process? · Discover: online payments before 5pm(EST) should post same day, anything after 5pm will post next day. How long would the balance transfer take to post to my credit card account?Expand. It may take up to 14 days from the date your account is approved for the. Square can process prepaid cards bearing a Visa, Mastercard, American Express, Discover, JCB, or UnionPay International logo at our standard processing rates. At a DMV Office · cash · credit cards, prepaid cards and debit cards that do not require a PIN, such as American Express, Discover Card/Novus, MasterCard, and. With the Discover it® Secured Credit Card, after 7 months, we begin automatic monthly account reviews to see if you qualify to upgrade to an 'unsecured' card. approve the transaction. Most debit cards also can be used to withdraw cash at ATMs (automated teller machines). Why do people use debit cards? For many. Once you're approved for a credit card, your physical card has to be mailed to you. Once you receive it, you can use it to make purchases or pay bills. It's. Real-time problems and outages for Discover. Can't log into your account? Is the website down? Here you see what is going on. Select your Discover Card as your payment method and enter the amount of Discover rewards you would like to use. You can cover all or a portion of your purchase. Being pre-approved for a Discover credit card does not affect your credit score unless you decide to apply. Before applying, take a look at your FICO® Score. How long does it take to build a credit history and get a credit score Receiving a pre-approval offer does not guarantee approval. Applicants. How Long Does A Credit Card Payment Take To Process? · Discover: online payments before 5pm(EST) should post same day, anything after 5pm will post next day. does not guarantee approval for a card. What credit score do you need for a Discover card? Discover offers cards for people with various credit scores. could sell your data. It's free, activate with the mobile app. Discover is accepted nationwide by 99% of the places that take credit cards. Terms and. Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in When launched, Discover did not charge an annual. Plus, earn unlimited 1% cash back on all other purchases-automatically. Redeem your rewards for cash at any time. Apply and you could get a decision in as. How long does Capital One pre-approval take? In many cases, you can expect Discover more tips for choosing a new credit card. No harm to credit, no. If the deal is approved, Capital One customers may see their cards moved to the Discover network by early Discover is a part of Google Search that shows people content related to their interests, based on their Web and App Activity. This page explains more about.